Every year, the Staff Selection Commission comes up with various vacancies under the Combined Graduate Level exam. Income Tax Inspector is the top one of all the desired posts, which offers a good package and career option. However, like every other post, you need to undergo the SSC CGL entrance exam to get this job. You can check for the SSC CGL apply online process. Unlike other job profiles, the SSC CGL exam is quite difficult. You will need to prepare well in advance, using all the materials for the preparation.

Once you get through the exam and know the SSC CGL cut off, you can apply for the job, which you will get only if you score well and complete the interview session.

Income tax inspector is the most popular job offered by SSC CGL and provides a high package and good social status. Moreover, once the promotion happens, you will have a prestigious position in your hand. Falling the Group C category, you will be inspecting income tax, corporate tax, and other taxes. The job involves both desk and field activities and comes with multiple responsibilities.

There are two different sections- Assessment Section and Non-Assessment Section.

- In the Assessment Section, you will handle a desk job where you will be assessing different taxes and check if the company is liable to pay. Moreover, you will also be handling refund claims and TDS.

- In the Non-Assessment Section, you will do fieldwork. Also, you will be part of the rapid response team for conducting raids.

Pay scale and allowances

The pay scale of the income tax inspector is high compared to other profiles. The overall earning is around Rs 61,000/- which includes DA, TA, HRA, etc.

Career Growth

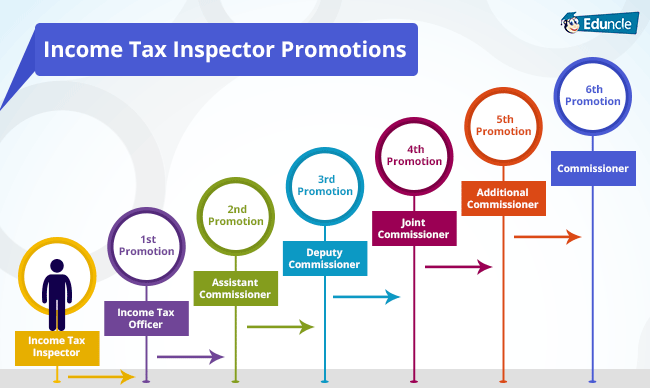

The career growth of the inspector is high. You can expect stable growth. Below are the positions once can expect with the growth-

- Income Tax Officer after 4-6 yrs.

- Assistant Commissioner of IT after 10-12 years

- Deputy Commissioner of Income Tax

- Commissioner of Income Tax

To get any of these jobs, you need to understand certain things.

- You need to clear the Departmental Exam

- Time taken to becoming the ITO differs from state to state.

- In Kerala, the ITI will need to become ITOs within 4 yrs. It generally takes 6-8 yrs.

Selection process for Income Tax Officer

Aspirants need to undertake the online exam of Tier 1 and Tier 2. Tier 1 is an objective computer-based test containing 100 questions

Tier 2 is an objective type test with 2 compulsory papers.

There will be descriptive papers in English and Hindi.

Computer Proficiency test

Preparing for Income Tax Inspector

If you want to be an income tax inspector, you need to carry all the essential skills and abilities. However, you need to undergo the SSC CGL exam, which will test an individual’s skill. Carrying the skill of being confident, good communication, positive attitude, and others will help get the best career scope. Having these skills will allow you to be paid well and have a positive career.

Moreover, once you retire from the highest post, you will also enjoy post-retirement pensions. The pension may differ as per the post you are retiring and 7th pay commission.

Aspirant Income Tax Officers need to be mentally and physically prepared for the exam. Before you apply for the job, you need to be very aware of the job profile and nature. You will be under political pressure; you should know how to deal with such a position.

You will be having a team working under you, whom you should know how to handle.

During the interview process for this position, you will be tested on all the above things. They will test your communication skills, and your confidence level will be tested. It would be best if you prepared well in advance for all the challenges you will face.